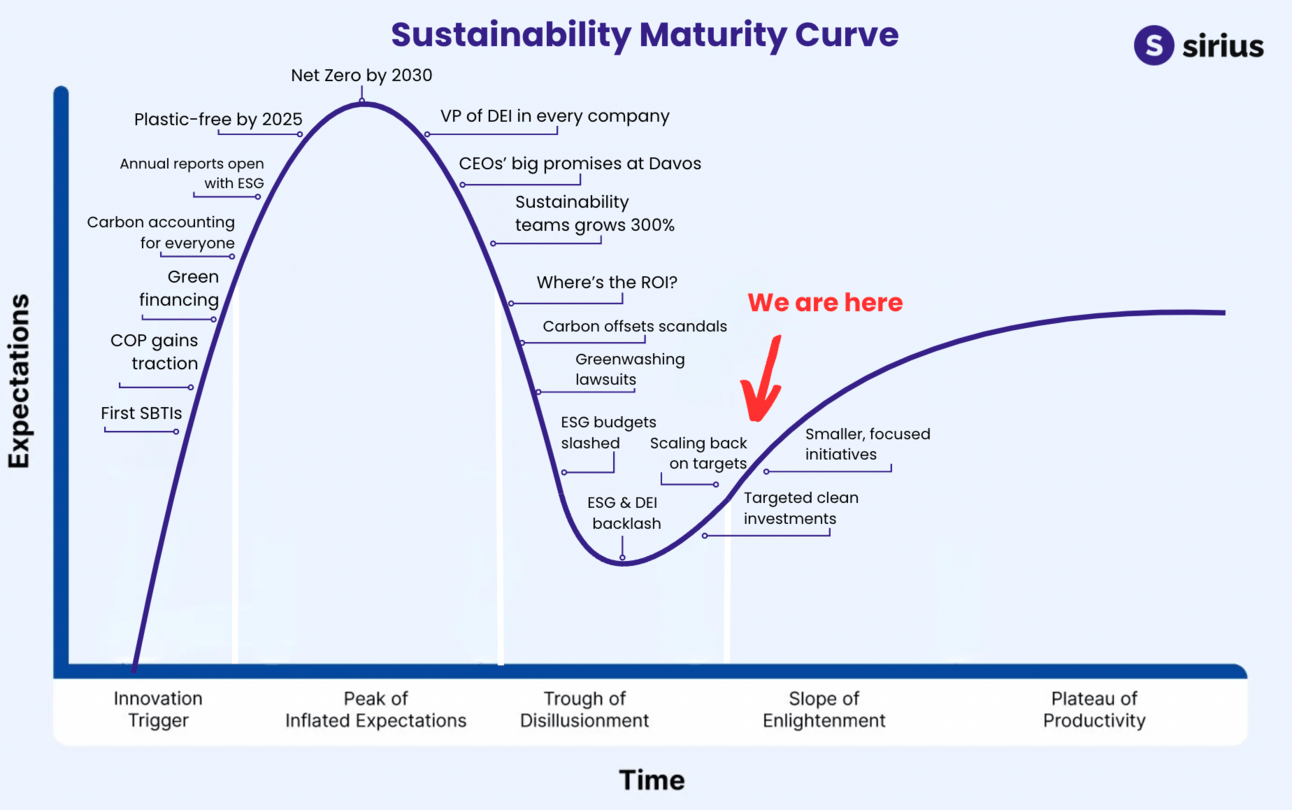

This shift is captured by the Sustainability Maturity Curve developed by beSirius, which maps the key milestones in the progression and consolidation of sustainability across organizations and global markets.

Its evolution mirrors that of other major business transformations experienced over recent decades, most notably digitalization.

In their early stages, these processes are typically characterized by a strong initial push and high expectations.

At its base, the maturity curve identifies an “Innovation Trigger” phase, in which new practices and commitments emerge. In the case of sustainability, this translated into the setting of emissions-neutrality (Net Zero) targets by hundreds of countries and by most large companies, with goals for 2050 or earlier. According to the International Energy Agency (IEA), more than 70% of global CO₂ emissions are already covered by some form of net zero target1.

This initial momentum was accompanied by significant growth in ESG reporting and metrics. In 2024, more than 13,000 organizations in nearly 100 countries reported in line with the standards of the Global Reporting Initiative (GRI), representing an increase of more than 20% compared with 20202.

However, this phase was also characterized by the coexistence of highly ambitious objectives with still-immature execution capabilities.

The Sustainability Maturity Curve refers to the subsequent stage as the “Trough of Disillusionment.” At this point, some initiatives are reassessed or abandoned, particularly in the current economic and regulatory context, which places greater emphasis on pragmatism and prioritizes efficiency, administrative simplification, and measurable impact.

In the European context, various bodies have emphasized the need for sustainability-related policies to be aligned with socioeconomic realities and implemented through proportionate regulatory frameworks that avoid unnecessary3 administrative burdens, based on the premise that simplifying processes does not imply lowering standards.

Recent analyses by the World Economic Forum indicate that corporate sustainability strategies are increasingly shifting toward approaches in which economic impact and return on capital carry greater weight in decision-making4.

In this context, some organizations are streamlining their sustainability agendas by reducing peripheral ESG initiatives and prioritizing projects with direct operational impact, such as initiatives to improve the energy efficiency of their asset base. A shift is also being observed in sustainability teams, with more specialized structures and greater integration into key areas such as operations, finance, and industrial strategy. The objective is to ensure that sustainability investments contribute to business resilience, the reduction of structural costs, and enhanced competitiveness.

Along these lines, the European Commission has emphasized in various documents associated with the Green Deal Industrial Plan that the energy transition must help preserve competitiveness and attract investment, aligning environmental objectives with economic and industrial-policy considerations5.

For its part, the European Central Bank has pointed out that fluctuations in energy prices and investments in energy infrastructure have a direct impact on corporate investment and long-term economic growth,6 in line with the findings set out in the Draghi report.

In the future, sustainability will no longer be perceived as an aspirational domain but will become an integral part of core business strategy, industrial planning, and risk management. This represents the most advanced end of the sustainability maturity curve identified by beSirius as the “Plateau of Productivity,” where sustainable practices generate tangible value. At this stage, initiatives focused on measurable impact prevail, with the sustainability function fully integrated into key business areas and projects directly linked to financial, operational, and market outcomes.

Tracking where capital is currently being allocated helps dispel doubts as to whether the energy transition is dependent on shifting political circumstances. The data indicate that it is not: investment in renewable energy and energy efficiency continues to grow globally, particularly in China, which has clearly recognized that the most effective way to strengthen future energy security is through the use of domestically sourced renewable energy.

According to Bloomberg, in the first half of 2025 Europe increased its investment in renewables by 63%, reaching 76 billion dollars, becoming the world’s second-largest investment region, ahead of the United States, where investment declined by 36%, and still well behind China. With 169 billion dollars invested over the same period, China has led global renewable investment over the past decade. In addition, it increased exports of solar panels to Africa by 60% and launched more than 500 green-hydrogen projects in 2025.

Similarly, the International Energy Agency’s Global EV Outlook highlights progress in electrification and energy efficiency across economies with diverse political contexts, all of which continue to pursue energy diversification and reduced dependence on fossil fuels.7

The International Energy Agency shows that achieving deep emissions reductions requires combining electrification (“electrons”) and energy efficiency with other energy vectors, including green molecules, where electrification faces technical or economic constraints. Sectors such as aviation and maritime transport, which together account for around 6% of global CO₂ emissions, are difficult to decarbonize using renewable electricity alone8. As a result, solutions such as second-generation biofuels, the replacement of natural gas with biomethane, and the development of fuels based on renewable hydrogen are becoming increasingly important. These solutions are complemented by carbon-capture technologies and renewable energy-storage systems.

Ultimately, when viewed with a long-term perspective, what is changing is not the direction of the energy transition, but its pace and architecture. Sustainability is becoming more pragmatic and technology-agnostic, enabling realistic progress toward a shared objective: building a better future for ourselves and for generations to come.

**Opinion piece published on January 28 in Expansión.